Earlier this month, BharatPe unveiled a new service named "Shield," specifically designed to protect its users from the ever-growing threat of UPI fraud. As the digital payment ecosystem continues to expand and online scams become increasingly frequent, this initiative represents a vital step in safeguarding users from the risks associated with online transactions. With the rise of phishing attempts, unauthorized transactions, and other forms of fraud, Shield aims to provide users with a robust layer of security, ensuring that they can continue making digital payments without the fear of financial loss, even if they lose their phone.

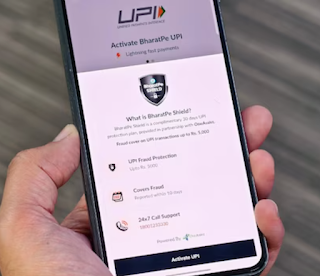

One of the most attractive features of Shield is its accessibility and affordability, which are essential in making digital protection available to a wide audience. Users can enjoy the service for free during the first 30 days, offering them a risk-free opportunity to experience the protection firsthand. After the trial period, the cost is a minimal Rs 19 per month, which is an affordable price to pay for the peace of mind that comes with knowing that your digital transactions are safeguarded. The service provides coverage of up to Rs 5,000 against fraudulent activities, offering significant financial protection for users who may fall victim to scams or unauthorized transactions.

The process of getting started with Shield is incredibly user-friendly. The service is available directly through the BharatPe app, which can be easily downloaded on both Android and iOS devices. Once the app is installed, users can activate Shield directly from the app’s homepage by clicking on the relevant banner. However, to ensure that users are actively engaged in the digital payment ecosystem, first-time users must make a minimum payment of Rs 1 to any contact or business before they can activate the service. This simple requirement helps establish the user’s active participation in digital transactions, which is a prerequisite for benefiting from the protection Shield offers.

In the unfortunate event that a user becomes a victim of fraud, BharatPe has made the process of registering a claim as simple as possible. To streamline the claims process, the platform has partnered with OneAssist, a leading provider of assistance services. Users can either download the OneAssist app or call the dedicated toll-free number at 1800-123-3330 to report the incident. It is crucial, however, that users report the fraud within 10 days of the incident occurring in order to qualify for a claim. The 10-day window ensures that claims are processed promptly and that fraudulent activities are addressed quickly.

To submit a claim, users may be required to provide specific documentation, depending on the nature of the fraud they have experienced. Typically, required documents include a UPI transaction statement, a copy of the police report or FIR, a completed claim form, and proof that the UPI account has been blocked to prevent further fraudulent activities. In some cases, additional documents may be required, depending on the specifics of the fraud. This thorough process ensures that all claims are legitimate and helps maintain the integrity of the service.

In today’s world, where digital payments have become a daily necessity, initiatives like Shield offer a much-needed safety net for users. As the number of people relying on digital payments continues to grow, so does the need for robust security measures to protect against fraud. While Shield provides an essential layer of protection, users need to remain vigilant in their everyday online activities. They should avoid clicking on suspicious links, downloading apps from unverified sources, and sharing sensitive payment information with unknown parties. Being cautious is an essential part of ensuring that one’s online transactions remain secure.

BharatPe’s Shield is a timely and thoughtful addition to the rapidly expanding digital payment ecosystem. As more and more people rely on UPI for everything from grocery shopping to paying bills, having a service like Shield adds an important layer of reassurance. While no system can completely eliminate the risks associated with online transactions, Shield offers practical, cost-effective protection that empowers users to make digital payments safely. By providing this service, BharatPe is not only helping to ensure the security of its users but also contributing to the broader effort to create a safer, more reliable digital payments environment for everyone. With initiatives like Shield in place, users can feel more confident and secure as they continue to navigate the digital world.